Outsource Accounting Receivable Services

The organization and administration of the customer debt owed as a result of credit sales are referred to as “management of receivables”. To put it another way, you can only successfully close your order to sales, when you convert your sales into cash.

Account receivables are the unpaid bills or funds that you have received from customers but have not yet received payment for. Such invoices or funds are recorded as accounts receivable until they are paid.

Receivable management, put simply, is the management of unpaid bills and debt. The number of credit sales and the fact that accounts receivable are one of the primary sources of cash inflow result in a sizable amount of money being locked up in these accounts. This merely implies that, until it is paid, a sizable sum of money will not be available. These directly impact the business’s working capital and could impede its growth if they are not properly managed.

Accounts Receivable Services We Offers

Maintaining a record of the bills

Regular billing and delivery to customers

Creation of invoice

Adjusting the payments with invoices

Record of received payments

Linking Payment Gateways and the Accounting software

In-depth analysis of accounts receivable reports

Discounting the debtors

Constant follow-ups with debtors for pending invoices

Accounts Payable Outsourcing

Business process outsourcing (BPO) is a superset of Accounts payable outsourcing. The company hires an experienced outsourced accounting firm to electronically capture and process its accounts payable, payments and vendor invoices to reduce the in-house financial workload.

Accounts payable are short-term debts or unpaid bills that a business owes to suppliers or creditors that have not yet been settled. This term excludes long-term debts, such as mortgages. It also includes payroll outsourcing. Irrespective of the size of your business, in order to safeguard your money and assets and keep from paying for false invoices, it’s critical to pay close attention to your Accounts Payable expenditures.

Accounts payable are typically documented after receiving an invoice, depending on the payment terms that were agreed upon when the transaction was first initiated. The general ledger is updated as an expense when the finance department creates a journal entry and receives a valid bill for goods and services. Despite not listing specific transactions, the balance sheet shows the number of accounts payable.

Payables Management

The balance sheet's section for short-term liabilities should contain accounts payable. It primarily entails funding worthwhile short-term operations like buying inventory, covering incurred costs, and other comparable things.

Among the tasks involved in the management of payables, the following included: ensuring and finding trade credit lines, obtaining favorable conditions for purchases, and controlling the time of purchases.

Banking and General Ledger Maintenance

A general ledger keeps track of all the bank accounts that are used to record transactions involving a company’s assets, liabilities, owners’ equity, revenue, and expenses. A general ledger’s primary goal is to display current balances in significant areas. Assets, Income, Expenses, and Liabilities are the essential divisions that make up a general ledger. The general ledger is the cornerstone of any accounting system, organizing both financial and non-financial data.

A list of bank accounts can be found in the general ledger. Every such account is known as a ledger account. For this, a non-computerized system might employ or utilize a big book.

Cash Flow Analysis

A thorough analysis and assessment of a company's cash financing, inflow and outflow from operations, and investing activities are known as cash flow analyses. In simpler terms, a cash flow analysis helps to evaluate how exactly a business is generating its revenue flow, where it comes from, where the revenue generated goes and is invested into, etc.

Benefits of Hiring Outsourcing Accounting Company

- Expert access to finance and accounting

- Cost saving in terms of salaries, taxes and unemployment

- Time savings for the business

- Gain flexibility to meet business needs

- Ability to scale up’s or down’s of business growth

- Improves business intelligence

- & more

Sales of products, services, and goods, loan repayments, payments made to accounts receivable, and other cash flow make up your cash inflow. Operating costs, investments, and asset purchases make up your cash outflows. The balance sheet’s section for short-term liabilities should contain accounts payable. It primarily entails funding worthwhile short-term operations like buying inventory, covering incurred costs, and other comparable things.

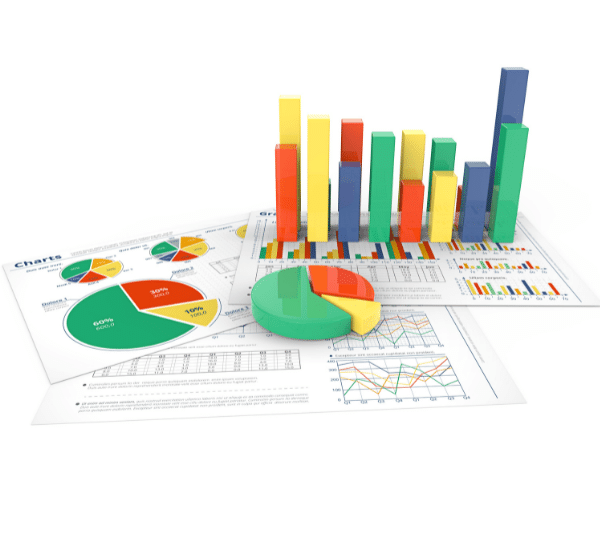

Reporting

A financial report that displays a company’s past and present financial situations are extracted. With the help of this report, businesses and financial analysts can more accurately forecast their future financial situation.

An accounting report usually contains crucial data and information from all areas of the company or it may only concentrate on a specific objective, like identifying the department that uses cash flow the most. Companies that wish to pay close attention to their finances, may opt for financial reporting. This helps them to organize the business goals for the future. A quick report is tailored towards a specific company’s needs and helps them grow in accordance.